As we embark on Longtail Renewal automation (low dollar / high volume) - looking for best practices

Many hardware / software companies struggle w/ the sales motion and GTM around longtail renewals (these are the renewals that are low dollar, but high in volume or number of quotes). It requires a different sales motion from the more complex, higher-dollar renewals where there is a possibility of upsell and customization. These are renewals that just need to be automatically quoted and sent out the door for the Channel / end customer to auto-renew and click to pay, possibly with a credit card. Would love to hear what other companies are doing from a people, process and tool standpoint and if anyone has solved for this issue already or are also embarking on this journey?

Answers

-

Hi Lynn

We are currently dealing with this in our organisation. We are undergoing a process to review the longtail, where we need to decide what do we cut off, where is there an opportunity to grow (significant white space) and which clients do we just deal with in a purely low touch , transactional process which is fully automated. We do have some capability, but need to improve to completely automate. @Sashen Naidu , would you like to add anything?

2 -

Sonu / Lynn - Thanks for the conversation. This is a huge and important topic today, and not as clear as we would like.

1) Where do we draw the line? I completed a survey recently in which we found that 35% of survey participants had a Digital strategy. Of those that had a Digital strategy, 60% do not have a cap on the $ value, and the 40% that did have a cap indicated it was greater than 50K. Additionally - SW companies are by far leading the charge here, but HW companies are starting this journey. Discussions with members suggest that the key attribute for processing business via a Digital model is Complexity, not Dollar value. You may arbitrarily draw a line to box the opportunity in to a recognizable batch of business, but it's really complexity that determines ability to digitize.

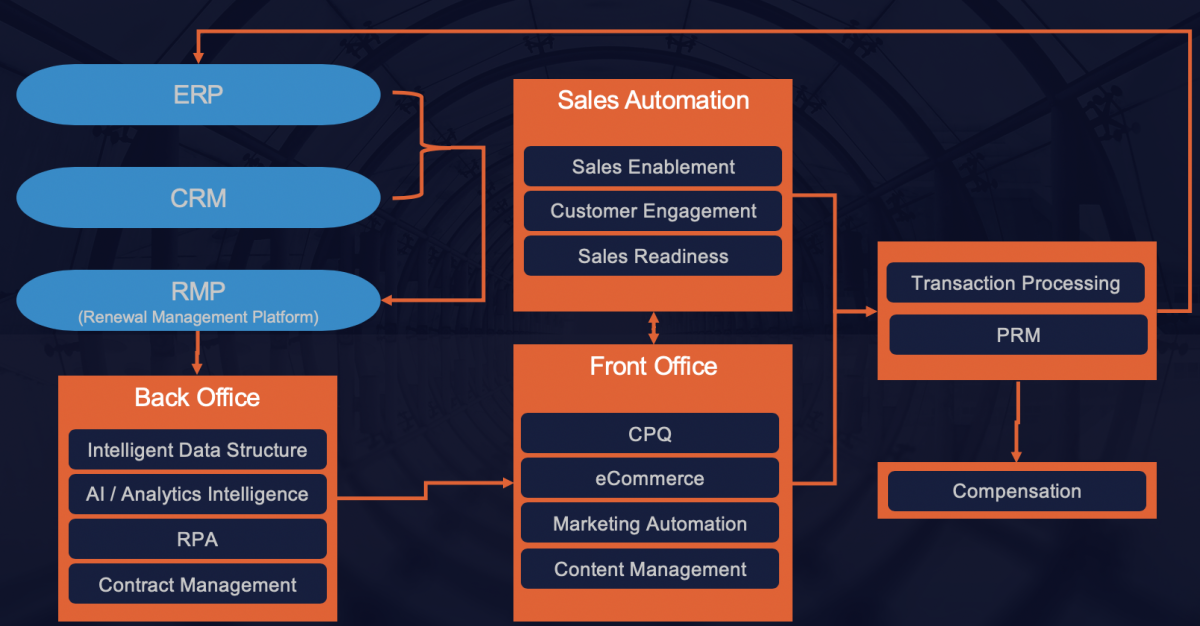

2) Bigger question - Technology stack in play today. John Ragsdale, our resident expert on technology here at TSIA, has done some great work on various technologies in play. One paper in particular, Building the Sales Digital Infrastructure, is instructive from a selling framework perspective. https://www.tsia.com/resources/slides-building-the-sales-digital-infrastructure. I'll be diving in to this topic over the next few quarters to build a Renewal specific framework for technology to compliment the work completed thus far.

Let's try an experiment: I brainstormed components of a renewals technology stack and placed it in this image as a starting point. I'd love to poke on this concept and add / delete / refine as you think proper. Add your thoughts.

1 -

Hi Jack - thanks for providing such a comprehensive response! We are starting the journey as you know, so I will be sure to give you an update once we get pen to paper on the architecture. I agree on the point regarding the arbitrary dollar threshold so this is food for thought as we determine where to put a stake in the ground related to complexity instead. Thank you!

0 -

Hi Lynn, Sonu, and Jack,

I agree with the comments that Lynn and Jack made about the concept of where to cut the tail on longtail transactions: It's more about complexity than it is about dollar volume. There are of course other factors involved:

- Segmentation of customers (ARR, product complexity, etc.). Key is to match customers to a service & delivery approach (tech touch, human touch, or hybrid touch) that is economically cost effective for the ARR level of the customer.

- Customer experience. Most longtail customers will have a better experience through automation of basic tasks (e.g., renewal), where they are not currently treated as a high priority customer and often confront a lot of friction in the buying process.

- Another factor is of course looking at the customer segments where channel partners and possibly direct sales teams are significantly underperforming on renewal and/or expansion. This often falls in the <$20k ARR range. Perhaps they lack sufficient economic incentives or the right tool sets to do this effectively.

Happy to discuss further.

For some reason my TSIA Exchange notifications had to be reset and I didn't see your questions until now, so sorry for the tardy response.

Thanks,

Doug

1 -

Thanks Doug, excellent feedback!!

0 -

Awesome feedback. I am still struggling with this - its a multi-year struggle....

Nothing to add past what has been posted - but thank you for the thread and all the comments.

0 -

Hi @Wesley Chappell. On the longtail renewal front you might find this on-demand webinar interesting, which I did with Julia Stegman last year: https://www.tsia.com/webinars/automating-your-low-dollar-long-tail-renewals

0 -

For Services Subscriptions using credits, does it make sense to automatically renew credit packs, or just the subscriptions? We are trying to determine how much of the credit counts are cycical vs re reocurring services levels? any experience or feedback on this.

1